How to Read Your Insurance Card

What is an insurance card?

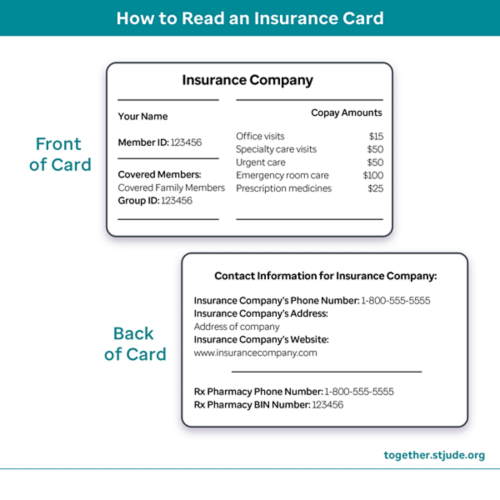

An insurance card shows that you have health insurance. Your insurance card also helps your health care provider know how to bill your insurance company.

You may need this card when you visit your health care provider, go to the pharmacy, or if you need hospital care. Understanding how to read your insurance card can save you time and prevent mistakes.

How an insurance card works

Your insurance card tells health care providers who your insurance company is, what type of plan you have, and how to contact the insurer. It may also list how much you need to pay during a visit. These details help providers check your coverage and make sure your care is billed correctly.

Most cards contain certain terms to explain different points about your health insurance coverage.

Policy holder

The policy holder is the person who owns the insurance plan. Their name is usually on the card. This might be your name, or it may be a parent or caregiver.

Some cards also list the names of covered family members. These names may be different from the policy holder.

Member or policy number

All health insurance cards should have a number that identifies you to the insurance company. It may be called:

- Member ID

- Policy ID

- Policy #

- Subscriber ID

- ID number

Your insurance company uses this number to keep track of your health care claims. You may be asked for this number when you schedule a visit.

Group plan number

If you have health insurance through work, your card may include a group number. This number helps the insurance company identify your employer’s plan.

Not all insurance cards have a group number. Many public insurance plans do not use them.

Insurance company contact information

The back of your card usually lists contact information for your insurance company. This might include:

- Phone numbers

- Address

- Website

You may contact your insurance company to:

- Check your benefits (what the plan pays for)

- Ask if a doctor or hospital is in your network

- Understand your costs

- Ask questions about bills or denied claims

How to Understand Health Insurance

Martin Ribulotta does standup comedy, but dealing with health insurance does not always make him smile. Learn tips and tricks from a childhood cancer survivor, a psychologist, and a legal expert.

Read the article

Coverage amounts, networks, and co-pays

This information helps you understand how much you might have to pay for certain types of care.

Coverage amounts

Coverage amounts may be listed as percentages. These percentages often show how much you pay and how much the insurance company pays.

Your card may list different percentages for services such as:

- Office visits

- Specialty care

- Urgent care

- Emergency room care

If you are not sure or have questions about what the percentages mean, check your plan materials or call your insurance company.

Networks

Most insurance cards show information about “in-network” and “out-of-network” care.

- In-network providers: Your insurance company has an agreement with these doctors and hospitals. You usually pay less to see them.

- Out-of-network providers: Your insurance company does not have an agreement with these providers. You may pay more for care.

Some plans, such as health maintenance organization (HMO) plans, do not cover out-of-network care at all unless it is an emergency.

If you are not sure if a provider is in your network, call your insurance company or check your plan website.

Co-pays

A co-pay is a set dollar amount you pay for certain types of care or medicine. Many cards list co-pays for services such as:

- Office visits

- Specialty care visits

- Urgent care

- Emergency room care

- Prescription medicines

If this information is not on your insurance card, call your insurance company. They can let you know details about your plan.

Your health insurance company may help pay for the cost of prescription medicines. Your card may have:

- An “Rx” symbol

- A separate pharmacy phone number

- Pharmacy processing numbers such as BIN, PCN, or a pharmacy group number

Not all cards list prescription details, even if your plan covers medicines. If you do not see this information, call your insurance company or check your plan documents.

For questions or concerns

If your insurance card has information you do not understand, call the number on the back. The insurance company can explain your benefits, your costs, and how your coverage works.

Key points about how to read your insurance card

- Your insurance card has information about how your health coverage works.

- You can usually find your member ID, network details, and copays on your card.

- Not all cards list the same information, so your card may look different from someone else’s card.

- If you have questions about how your coverage works, call your insurance company.

-

Understanding Health Insurance

Health insurance helps families pay for doctor visits, medicines, and treatments. Learn the basics of health insurance, costs, and options in the United States.

-

How to Figure Out What Health Insurance Covers

Learn how to understand your child’s health insurance coverage. Find out what services, tests, medicines, and home care may be covered.

-

Covering Out-of-Pocket Expenses

Out-of-pocket medical expenses are the costs not covered by health insurance. Learn about insurance coverage and ways to manage health care expenses.